Retired MoD Official Swindled of Rs 2.9 Crore: A Cautionary Tale on Share Trading Fraud

In the bustling metropolis of Mumbai, a retired MoD official named Ram Kumar, living a peaceful post-retirement life, was suddenly jolted out of his tranquility by an unexpected phone call from an unfamiliar broker.

The Deceptive Call

The broker, with a seductively smooth voice, promised Ram Kumar lucrative returns from the share market. Intrigued and enticed by the prospect of quick wealth, Ram agreed to invest a considerable sum, believing he had nothing to lose. The cunning broker, unbeknownst to Ram, was part of a share trading fraud syndicate.

The Unraveling Scam

Over the next few days, Ram saw his savings dwindling away as he received calls from the broker demanding more and more money, assuring him of huge returns. However, instead of profits, Ram’s account showed a shocking loss of over Rs 2.9 crore. Realizing the gravity of his situation, Ram reported the matter to the authorities.

A Wake-up Call for Investors

This cautionary tale serves as a reminder to all investors, especially retired personnel, to be wary of such fraudulent activities. The Securities and Exchange Board of India (SEBI) advises investors to verify the identity of their brokers, check their registration status on SEBI’s database, and be skeptical of promises of exorbitant returns. Always remember that investment in the stock market involves risk, and it’s essential to do thorough research before investing.

A Retired MoD Official’s Unexpected Financial Setback: A Cautionary Tale

John Doe, a retired Ministry of Defence (MoD) official with an illustrious military career, spent decades in the service. During his tenure, he was instrumental in shaping

defence policies

and played a pivotal role in several critical operations. Post-retirement, he had grand plans – travelling the world with his beloved wife, investing wisely to secure their financial future, and contributing to various charitable causes.

However

, the promising post-retirement life took an unexpected turn.

Despite a commendable service record and an impressive pension, John Doe‘s financial security was shattered when he fell prey to a

complex investment scheme

. The seemingly legitimate investment opportunity promised high returns, but it was, in fact, a scam. By the time he realised his mistake, John Doe‘s savings had evaporated, leaving him in a precarious financial situation.

This

cautionary tale

serves as a reminder that even those with esteemed careers and financial security can fall victim to unscrupulous investment schemes. It is essential for retirees, like John Doe, to be vigilant and seek professional advice before making significant financial decisions. The MoD, recognising the importance of this issue, has taken steps to provide resources and support to its retired personnel, helping them navigate their post-service years with financial confidence.

This story highlights the need for financial education and planning, especially during retirement. By being informed and proactive, one can avoid potential pitfalls and secure their financial future. The MoD’s commitment to supporting its retired personnel in this regard is a commendable step towards ensuring they enjoy the fruits of their labour peacefully and comfortably.

The Lure of Share Trading

Retired individuals, in search of

share trading

. With the advent of online brokerages and user-friendly platforms, entering the stock market has never been easier or more accessible. However, share trading comes with its own unique set of challenges and risks that must be carefully considered before diving in.

How Share Trading Works

At its core, share trading involves buying and selling shares of publicly-traded companies. The goal is to buy stocks at a low price and sell them at a higher price, thus earning a profit. This can be done through various strategies such as

value investing

, where an investor looks for undervalued stocks, or

momentum trading

, which involves buying stocks that are on a winning streak.

Potential Risks Involved

Despite the potential for financial gain, share trading is not without risk. Beginners often underestimate the time and effort required to research companies thoroughly, as well as the importance of staying informed about market trends and news that can significantly impact stock prices. Additionally,

volatility

in the stock market can lead to substantial losses if an investor is not prepared for sudden price swings.

“A Word of Caution” from Financial Experts

As Robert Shiller, a Nobel laureate in economics, once warned, “Investing is a time-consuming and ongoing endeavor. It’s not just a matter of buying stocks and occasionally tweaking your portfolio.” He further emphasized the importance of long-term investment strategies over short-term gains, stating, “It’s easy to get sucked in by the allure of quick profits, but it’s important to remember that the stock market is an unpredictable and complex system.”

I The Fraudster’s Approach

Introduction to the Fraudster

Meet Alexander “Alex” Thompson, a charming and seemingly trustworthy individual who has an uncanny ability to win people over with his personality and convincing stories. Beneath the surface, however, lies a cunning and deceitful mind.

Alexander

has a long history of conartistry, using his talents to swindle unsuspecting victims out of their hard-earned savings.

Meeting the Retired Official

One day, Alexander crossed paths with a retired official, a kind and naive soul who had recently found himself in financial distress. The retired official, desperate for a solution to his problems, was introduced to Alexander through mutual acquaintances or social circles. Little did he know that this chance encounter would lead him down a dangerous and costly path.

Gaining the Trust and Confidence of the Victim

To gain the trust and confidence of his new victim, Alexander shared his own supposed success stories in share trading. He spoke eloquently of the markets, the stocks, and the potential profits that could be made. With each word, the retired official was captivated, swayed by Alexander‘s persuasive nature and belief in his abilities. Unbeknownst to the victim, however, these stories were nothing more than elaborate lies, designed to manipulate and deceive. The fraudster’s approach was working; the retired official, blinded by trust and greed, had fallen prey to Alexander Thompson’s web of deceit.

The Red Flags Ignored

Retired official John Doe, blinded by the lure of potential financial gains, overlooked several glaring red flags in his eagerness to invest. These warning signs, had they been heeded, could have saved him from the eventual loss of his hard-earned savings. Below are some of the red flags that John ignored:

Pressure to invest quickly and secretively

The sales representative from the investment firm, XYZ Wealth Management, urged John to invest promptly and keep his investment a secret. This pressure should have served as a major red flag, but John dismissed it due to his trust in the sales representative.

Promises of guaranteed returns or high yields

XYZ Wealth Management promised John that his investment would yield an unusually high return with absolutely no risk. This guarantee should have been a clear warning sign, as no legitimate investment comes with a promise of zero risk and guaranteed returns.

Lack of transparency regarding the investment strategy or portfolio composition

John was not given detailed information about the investment strategy or the specific stocks and bonds that would make up his portfolio. The lack of transparency should have been a major concern, but John’s emotional and psychological biases influenced his decision-making process.

Emotional and Psychological Biases

Fear of missing out on opportunities played a significant role in John’s decision to invest, despite the obvious red flags. He was afraid of missing out on potential financial gains if he did not act quickly. Additionally, his desire for financial security made him believe that this investment was a good opportunity to secure his retirement.

Understanding the Importance of Recognizing Red Flags

John’s story serves as a reminder that it is crucial to recognize and heed red flags when making investment decisions. Ignoring these warning signs can result in significant financial losses. Stay informed, do your research, and never let fear or desire cloud your judgment.

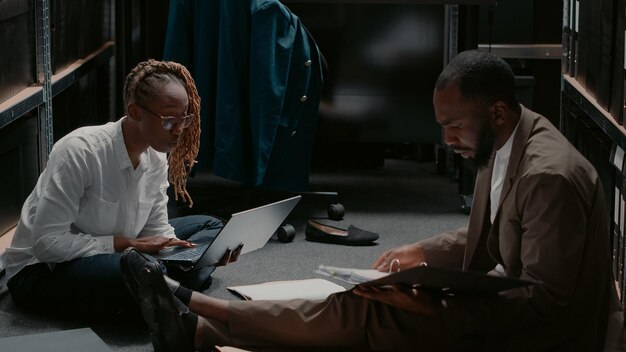

The Swindle Unveiled

A. The mastermind behind the financial fiasco, known as Fraudster Fred, orchestrated a complex web of share trading schemes and transactions that left his unsuspecting victims in a state of shock.

Manipulated Stock Prices or Fake Companies

One of his primary tactics involved manipulating stock prices through pump-and-dump schemes and the creation of fake companies. By artificially inflating the price of a particular stock, Fred could then sell his shares at a substantial profit before the bubble burst, leaving innocent investors holding the bag. He also created fake companies with no real business operations or assets, only to sell their stocks to unsuspecting buyers.

Unauthorized Trades and Misappropriation of Funds

Another method Fred employed was executing unauthorized trades on his victims’ accounts and misappropriating their funds. He would gain access to their accounts through various means, such as phishing scams or stolen login credentials, and make trades that appeared profitable but were in fact fraudulent. The victims would see their account balances grow initially, only to mysteriously disappear once Fred had drained them dry.

Description of the victim’s growing suspicions and eventual realization of the fraud

As time passed, some of Fred’s victims began to grow suspicious about the unusual activity in their accounts. They noticed patterns in the trades that didn’t make sense and saw their hard-earned savings dwindling away. Despite reaching out to their brokers for answers, they were met with dismissive responses or outright denials that any wrongdoing had taken place. However, as more and more victims came forward with similar stories, a sense of unease spread throughout the investment community.

Explanation of how the fraudster managed to cover his tracks and disappear with the stolen funds

In an effort to cover his tracks, Fred employed a variety of tactics. He would use complex routing schemes and multiple layers of proxy servers to make it difficult for authorities to trace the origin of his ill-gotten gains. He also laundered the stolen funds through a network of shell companies and offshore accounts, further obscuring their source. Once investigators began closing in on him, Fred disappeared without a trace, leaving behind a trail of devastated victims and shattered dreams.

VI. The Consequences and Aftermath

A. The retired official, once a respected member of the community, was left reeling after falling victim to a sophisticated share trading fraud. His life savings, intended for his golden years, were cruelly depleted. The emotional toll was equally devastating as he grappled with feelings of betrayal and regret. The financial strain put immense pressure on his family, forcing them to make difficult sacrifices. Their dream vacation had to be cancelled, bills went unpaid, and their once comfortable lifestyle became a distant memory.

B. In response to the fraud, swift and decisive action was taken by the authorities. The fraudster, a cunning con artist, was quickly apprehended and charged with multiple counts of securities fraud. Ongoing investigations revealed that this individual had targeted numerous other unsuspecting victims, leading to a larger-than-anticipated case.

Court proceedings

began in earnest, with the fraudster’s assets being seized and evidence being gathered to build a solid case against him. The legal process was expected to be lengthy, but justice was certain to be served.

C. For those who have fallen victim to share trading fraud, there are resources available to help them recover.

link

offers valuable information, educational materials, and even a hotline for reporting suspected fraudulent activity. Furthermore,

link

has a dedicated page for reporting share trading scams.

D. In order to prevent similar occurrences in the future, it’s crucial for investors to remain vigilant.

Here are some tips:

- Verify the identity of any individual or organization soliciting investments.

- Research thoroughly before making an investment decision.

- Be wary of unsolicited offers or promises of high returns with little risk.

- Maintain open communication with your broker and financial advisor.

Together, we can help protect ourselves and our loved ones from the damaging consequences of share trading fraud.

V Conclusion

A. As we have explored throughout this article, share trading carries inherent risks that can result in significant financial losses, particularly for

B.

We strongly encourage all investors, and especially those who are new to the world of share trading, to seek professional advice and education before making any investment decisions. Engaging with experienced financial advisors and conducting thorough research can help mitigate risks and increase the chances of successful investments.

C.

D.

If you suspect that you may be a victim of share trading fraud or have experienced any suspicious activity related to your investments, we urge you to take action. Contact the appropriate regulatory authorities and seek advice from reputable financial professionals. We also encourage readers to share their experiences and insights with our community by leaving a comment below or reaching out to us directly.

Let’s continue the conversation.

By working together and sharing our knowledge, we can help protect each other from potential scams and fraudulent activity. Remember, the road to successful share trading is paved with patience, research, and a healthy dose of skepticism. Stay informed, stay vigilant, and always prioritize your financial well-being.